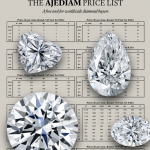

Diamond Prices

Read more

Are Diamonds a Good Investment? An Objective Analysis.

While investing in diamonds should not be compared to buying mutual funds, it does present a valid complementary opportunity to traditional investment classes. In this guide, we aim to provide an unbiased assessment of diamonds as an investment, outlining their advantages and disadvantages while also comparing them to other types of investments. As industry professionals our answer to the question: “Are diamonds a good investment?” will always be: “YES, if you know how and what to buy”. Whether you’re an experienced investor or new to the world of diamonds, this objective analysis will equip you with the knowledge to make informed decisions and explore the full potential of investment diamonds.

1. Diamond Investment Advantages: Portability, Privacy, and Permanence

Before we delve into the intricacies of diamond investments, let’s grasp the fundamental aspects. Diamonds, celebrated for their rarity and enduring value, boast a track record of resilience even in the face of economic fluctuations.

What sets diamonds apart from other investments is their unique set of advantages. Their tangible nature renders them an appealing alternative to traditional investments such as stocks and bonds. Unlike real estate, diamonds are highly portable, allowing for discreet ownership. This feature can be particularly valuable in countries where privacy and security are paramount.

Moreover, diamonds, when set as jewelry, are not just an investment but also a source of joy within a family. They become heirlooms that can be passed down through generations, holding sentimental and historical significance. Additionally, the style of the setting can be transformed to suit evolving tastes, making diamonds a versatile and lasting asset.

In a world where the value of cash erodes at the pace of governments’ printing presses, diamonds stand as a beacon of stability. They outpace inflation and withstand the test of time, making them not only a valid investment choice but also a potentially interesting one.

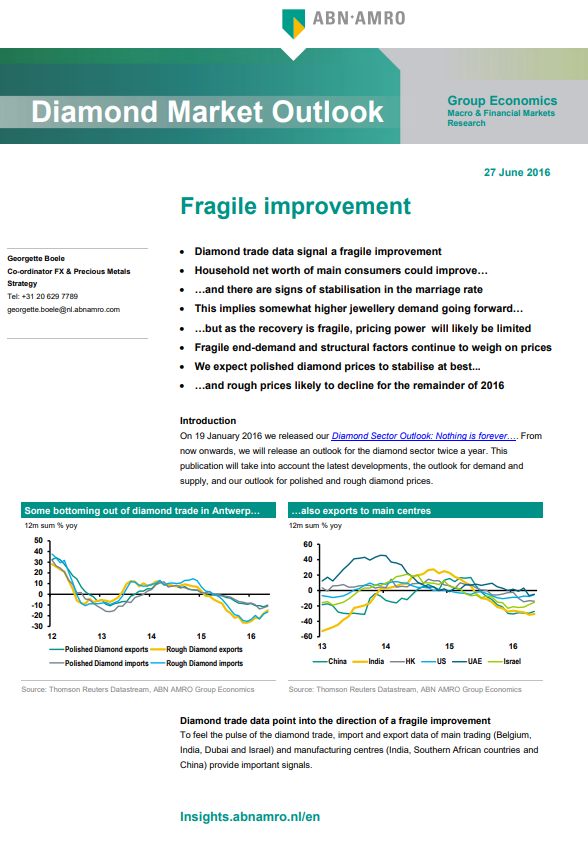

Market Intelligence: Reference Studies for the International Diamond Market

2. All the Ways You Could Invest in Diamonds

Investing well is diversifying a portfolio that will support you even in worst-case scenarios. When contemplating diamond investments, it’s essential to understand that there are primarily three avenues to consider: diamond jewelry, collecting investment diamonds, and investing in the business of diamonds. Let’s explore each of these options in detail.

a. Diamond Jewelry: A Treasured Legacy

Investing in diamond jewelry offers a unique blend of enduring value and sentimental significance. Gold and diamonds tend to maintain their value over time. The true purpose of fine jewelry transcends monetary gain; it’s about building a family legacy. Passing down a cherished piece of jewelry through generations is a heartwarming tradition. Moreover, the setting style of diamond jewelry can be easily modified, ensuring its adaptability to evolving tastes.

The challenge in buying diamond jewelry as an investment is buying it at the right price (explained in the next section). If you make a wise purchase, you can expect a fair resale value, even if it doesn’t match your original investment. Often people will buy diamond jewelry with high price tags for the wrong reasons which means there will be losses

In financial terms, diamond jewelry is a non-productive private asset that is as liquid and transportable as cash but beats inflation and potentially increases in value over the decades.

b. Collecting Investment Diamonds: The Art of Selection

The term “investment diamond” has been used and misused. We can’t stress enough that the single most crucial factor in making any investment, including diamonds, a success is acquiring it at the right price, namely wholesale. The moment you overpay, the purpose of your investment is lost. With this in mind, let’s delve into the specifics that define investment-grade diamonds. When we discuss investment diamonds, we’re typically referring to two categories: fancy-colored diamonds and larger white diamonds. Both have shown interesting price increases over the decades.

Fancy-colored diamonds: known for their vibrant and captivating hues, Fancy-colored diamonds are prized as investment gems. Their appeal transcends size, making them attractive assets regardless of carat weight. The key criterion is the rarity and intensity of the color, with at least a “fancy intense” grade being desirable. These diamonds, whether 0.20 carat, 1 carat, 3 carats, or more, stand out as valuable investments that have shown great performances over the years.

Large white diamonds: on the other hand, large white diamonds have different investment dynamics. To be considered a compelling investment, according to historical records, white diamonds should typically exceed 3 carats in size. These larger stones offer greater potential for long-term value appreciation. While smaller white diamonds have their charm and appeal, their price tends to be affected more by economic turmoil.

c. More Diamond Investments: Navigating the Landscape

Finding trustworthy investment funds can be a challenging endeavor, and it’s essential to exercise caution when evaluating their promises and opportunities. Here’s a closer look at some investment options within the diamond industry and their associated risks:

Crowdfunding Rough Diamonds: One approach involves crowdfunding rough diamonds, where investors can potentially earn returns from selling polished stones. However, it’s crucial to acknowledge the inherent risks. Rough diamonds can be susceptible to breakage, and the final polished product may not always meet the expected clarity or color standards. It’s important to note that, due to the highly competitive nature of the diamond market, returns on rough diamonds usually come from smaller off-cut stones left over from larger ones, adding complexity to the investment.

Investing in Diamond Trading Companies: In our opinion, one of the more stable and realistic options is to invest in well-established diamond trading companies that consistently generate profits. These companies have a track record and understanding of the diamond market. However, they often have limitations in terms of their sales capacity. A company that thrives with a $3 million capital might not achieve the same results with a $20 million capital, as they may lack the necessary sales channels.

Diamond-Backed Loans: Another alternative is to provide loans to the diamond industry, typically carrying high-interest rates. However, this route requires a thorough understanding of the law, taxation, diamond markets, and loan guarantee mechanisms.

Diamonds on the Stock Market: In all of these cases, it’s crucial to understand that the potential for gain is balanced by high risks. Without experience, the likelihood of losses outweighing gains is significant. In such cases, it may be wiser to consider safer options, such as investing in well-diversified stock market indices like the S&P 500. You can even explore funds that hold shares in diamond-related businesses, for example:

LVMH: Yahoo finance profile

Rio Tinto: Yahoo finance profile

Anglo American: Yahoo finance profile

Signet Jewelers: Yahoo finance profile

3. Tips for Buying Diamonds the Right Ways and Maximizing Your Investment

When considering diamond investments, it’s crucial to make informed choices that ensure ease of resale and maintain or increase resale value. Here are some tips from our experts:

a. 5 Questions to Ensure a Diamond is Not Only Good on Paper

Always insist on diamonds that come with reputable grading reports from established gemological laboratories. These reports authenticate the diamond’s quality and specifications, instilling confidence in your investment. When we, as professional diamond traders buy a diamond by distance, we briefly get on the phone with the seller and ask these five questions:

No BGM? This abbreviation stands for brown, green, and milky – three undesirable characteristics that can affect a diamond’s appearance and render the resale of your diamond almost impossible.

How is the Fluorescence? Always be mindful of fluorescence in a diamond. While not necessarily a negative trait, strong and medium fluorescence can impact a diamond’s appearance, and will always influence price.

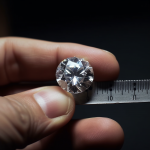

How are the Ratios? For fancy-shaped diamonds falling within the 55%-65% total depth range, assessing the shape ratios and brilliance becomes vital. The cut of a diamond is a critical aspect, distinguishing between ‘bluff stones’ and ‘spready stones.’

Where are the Inclusions placed? Inclusion placement matters significantly. Even within the same clarity grade, not all VS2 diamonds are equal. A well-placed inclusion hidden in the faceted edges can make a VS2 resemble a VVS stone, while a poorly placed one under the table, can downgrade it to an SI1 in appearance and price.

Is it a good E? Color grades encompass a range of intensities, and a single grade doesn’t capture all the nuances of a diamond’s color. Some companies utilize multiple subcategories for each color grade, providing a more detailed understanding of the stone’s color quality. For example E- ; E ; E+. The same goes for fancy diamond color intensity.

By delving into these additional aspects beyond the 4Cs, you’ll be better equipped to distinguish diamonds with genuine investment potential from those that may only appear promising on paper.

b. Get a Good Price for Your Investment Diamonds

Buying at the right price is the key to investing, in diamonds that means buying at the right place and a the right moment. When investing, consider purchasing diamonds at wholesale prices or through reputable auction houses rather than retail to avoid the brand and marketing premiums.

Furthermore, be aware that diamond prices are subject to fluctuations tied to the broader economy. Historically, they tend to increase as soon as talks of inflation start. This surge occurs as people seek to preserve their wealth in tangible assets like gold, real estate, and diamonds when they become aware of the diminishing value of their cash. Consequently, it’s prudent to avoid buying during these peaks and consider waiting for more favorable market conditions when prices are lower.

By carefully assessing the market’s timing and exploring alternative purchasing avenues, you can enhance your chances of obtaining diamonds at favorable prices, ultimately bolstering the potential for successful and profitable investments.

c. Know What Diamonds to Avoid

The success of a financial investment is only measurable by its resale value. For this reason, avoid synthetic diamonds at all costs. They hold no resale value in the market. Genuine, natural diamonds are the only option when seeking a return on your investment.

In that same perspective, diamonds with low clarity, suboptimal cuts, or inferior color quality can be challenging to resell. Investors should prioritize higher-quality diamonds in these aspects to enhance their marketability. Note that while we always recommend going for top-quality diamonds, flawless diamonds, even though they might seem enticing, come with their requirements. Their value as an investment can diminish if they are set in jewelry or handled without care, which almost always leads to the loss of the flawless grade. Flawless diamonds are to be kept loose in the safe.

Lastly, beware of high-premium jewelry brands. While high-end jewelry designer brands and heritage jewelry houses may seem desirable, they often come with hefty premiums that defeat the purpose of financial investment. If you’re inclined to invest in a designer piece, we suggest keeping it to the heritage houses, whose reputations withstand the centuries, and opting for exceptional pieces rather than commercial ones.

4. Comparing Diamond Investments to Other Investments

When evaluating diamond investments in comparison to more traditional investment options, several distinctions emerge:

Compared to Traditional Investments

Diamond investments, particularly in fancy-colored diamonds and larger stones, can offer substantial returns on investment. Understanding diamonds can be as complex as comprehending the financial markets. However, it’s important to note that, even though we strive to enhance transparency in diamond pricing at Ajediam, determining the price of a specific stock is often simpler than evaluating the value of diamonds, especially in fancy colors and significant sizes.

Compared to Owning Real Estate

As mentioned in the previous comparison, diamond investments do not typically generate passive income, making them incomparable to real estate investments, unless you are a professional trader. Nevertheless, owning diamond jewelry shares certain similarities with owning a home, albeit with significantly lower post-purchase expenses. When individuals invest in real estate, they often overlook additional costs such as renovation, decor, and maintenance.

That said, both owning a home and possessing diamonds offer similar advantages. You can derive daily enjoyment from your diamonds as jewelry, and they hold the potential to appreciate over time, provided you acquire them at a favorable price. Additionally, diamonds can be passed down to your children, creating a valuable family legacy.

The further advantage owning diamonds offers over the advantages of owning a house is their easy transportability and anonymity. In other words, diamonds offer more flexibility during urgent relocations.

Compared to Holding Cash

When juxtaposed with holding cash, diamond jewelry may not provide immediate liquidity (unless sold below its value), but it surpasses cash in the long term. Both gold and diamonds serve as effective hedges against inflation and have the potential to appreciate over decades, making them a preferable long-term choice over cash. These tangible assets provide security and the potential for sustained growth, offering an alternative to traditional cash holdings.