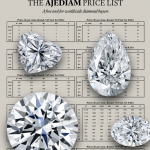

Diamond Prices

Read more

A Guide to Recover Lost Jewelry

How to handle insurances, replicate your jewel, and be preventive

Experiencing the loss or theft of a cherished piece of jewelry can stir a wave of emotions. The heartache goes beyond the monetary value, touching upon a deeper sentimental attachment. Guilt and self-reproach may surface, with questions on how we could have been more careful. The distress escalates when this loss stems from a home burglary. The violation of personal space and the unsettling feeling of an invaded sanctuary can be deeply traumatic. For those finding this article amid such unfortunate circumstances, we first extend our genuine empathy.

In this guide, we offer a comprehensive look at how to cope with the loss of valued jewelry, the steps to navigate your insurance policy, and how to rebuild or recreate your cherished pieces. We'll also provide strategic measures to mitigate jewelry loss, ensuring you're better prepared for the future. From understanding your insurance coverage to maintaining a detailed inventory and investing in home safety, these steps can provide an essential safety net for your valued possessions.

Navigating Your Insurance Policy

When it comes to replacing your lost or stolen jewelry, your insurance policy plays a critical role. However, understanding your coverage and knowing how to properly file a claim can often be complex and confusing. Here are some key steps to help you navigate through this process:

Identify Your Coverage

The first step is understanding what your policy covers. Many homeowner's and renter's insurance policies have a certain limit on jewelry coverage, often between $1,000-$2,000. If your lost item exceeds this limit, the policy may not cover its full value. Additionally, these policies usually cover theft but may not cover lost items. Therefore, it's crucial to review your policy details and understand your coverage.

Reporting The Loss

In the event of theft, report the incident to the police immediately. This report is a critical piece of documentation when filing your insurance claim. If the loss took place during travel, report it to the local law enforcement agency and keep a copy of the report.

Get in touch with your insurance provider as soon as possible. Inform them about the loss and ask about the process for filing a claim. They will guide you on the necessary steps and documents needed. Be prepared to provide specific details about the item, such as a description, the original purchase receipt, and any relevant certifications or appraisals.

File a Claim

Once you've gathered all the necessary documents, submit your claim. This will typically include the police report (in case of theft), proof of ownership, and any evidence of the item's value. Be as thorough as possible to avoid delays or complications.

In case your claim is approved, review your settlement options. Some policies may offer to replace the item, while others might pay out its cash value. Make sure you understand the terms and implications of each option.

Remember, it's crucial to regularly review and update your insurance coverage, especially when you acquire new valuable items. If your current policy doesn't offer adequate coverage, consider purchasing additional jewelry insurance. This could protect you from significant financial loss and provide peace of mind.

Rebuilding Your Cherished Jewelry with Ajediam

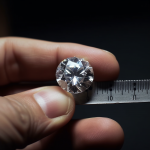

Losing a piece of jewelry is undoubtedly distressing, but it doesn't mean the end of its memory. At Ajediam, we offer a unique service that aims to breathe new life into your lost treasures.

Obtain a Professional Appraisal

Understanding the value of your jewelry is fundamental to safeguarding it. A professional appraisal provides a precise estimate of your pieces' worth, considering factors such as material, craftsmanship, and current market trends. At Ajediam, our experts can offer a detailed appraisal to ensure accurate information.

Discuss Jewelry Coverage with Your Insurance Provider

Knowing the specifics of your insurance coverage for jewelry is essential. Not all insurance policies automatically cover jewelry loss or theft, and the coverage limit may be lower than the value of your pieces. Speak to your insurance provider about the details of your policy and consider supplemental jewelry insurance if required.

After obtaining your jewelry appraisal and understanding your insurance policy, decide which pieces warrant insurance. While it may seem logical to insure all your pieces, keep in mind that insurance comes with premiums. It might not be cost-effective to insure jewelry of lower value.

Maintain a Comprehensive Jewelry Inventory

Having a detailed jewelry inventory is a critical step in mitigating loss. Your inventory should include high-resolution photos, detailed descriptions, grading reports, invoices, and any other related documents. If you do not have an invoice for a piece of jewelry, an appraisal is an acceptable substitute. It's important to provide this to your insurance provider and adjust the insured amount to the appraised value of the jewelry.

Home Safety

Finally, maintaining safety at home and keeping good care of your diamond jewelry is a vital step in jewelry protection. Invest in a good-quality safe for storing your valuables and be cautious.