Diamond Prices

Read moreHistorical Diamond Prices

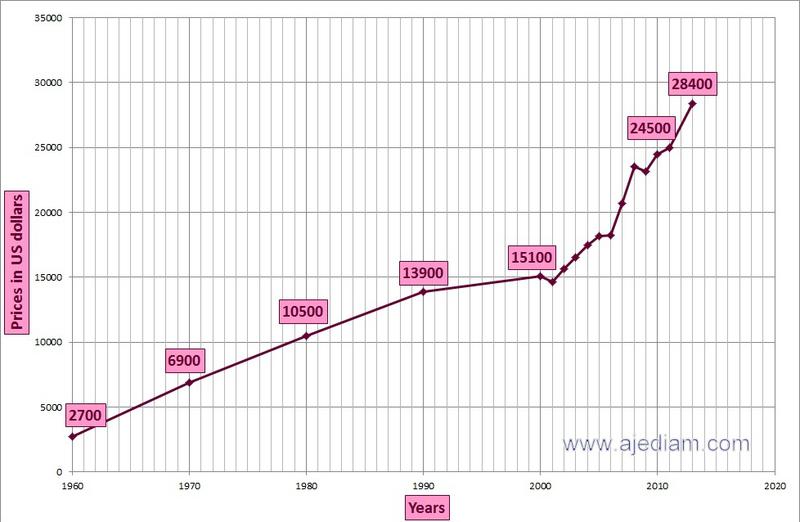

How to find diamond price history from 1960 to 2019 ? – The original Graph

Compare Historical diamond trade price trend evolution and performance graph statistic. View changes from 1960 to 2019 in data chart, diagram

Graph statistics: compare and analyze the performance development of over 58 years changes:

Index data tracking the historical diamond prices changes up to actual prices.

Diamond prices increases about 14% each year since 1960!

Discover now the three conditions to reach your investment target safely

Explore the return on investment! (ROI)

Get your free copy of the Historical diamond prices graph, email pleaseCopyright Ajediam

2018 Price for an extremely rare 1.00 Carat EX EX EX, H&A, Super Ideal Cut, Flawless, Girdle thickness medium Fluorescence none

Yearly increase of diamond prices and value +14.47% from 1960 to 2019

or equal to yearly compound interest of 4.3%

Past performance does not guarantee the performance of the future.

Read more about Diamonds as an investment, investing in

Diamonds Are a Girl's Best Friend and an Investor's Best Investment! If you decide to invest in diamonds it is a must to read this article.

Diamonds aren’t only a girl’s best friend but also an investor’s.

Investing in diamonds has become a better idea because of the production decline from Canadian and Russian mines. The price of the rough diamonds is higher than from cut diamonds; this will lead to higher cut prices!

Yet genuine top quality diamonds from reputable mines in Africa are of top choice and the supplies are low as well. Also,

the increasing demand, especially in China, has been a major factor in the supply and demand.

Many have assessed the diamond market. It’s becoming more stable because the economy is improving and China’s social trends.

Also the amount of diamonds mined has decreased significantly.

Many don’t invest in precious gems because it’s a challenge to value and accurately certify each stone.

Many people also don’t understand how to invest in gems that go up in value every year.

This is due mainly to the fact that there is so much fraud in the diamond industry.

Many sellers, jewelry stores and wholesalers don’t offer the genuine article.

Instead, they sell diamonds that have been mixed with fake ones (a mixture of CZ or other by- products)

and/or have enhanced them to look better.

Even the certifications are rigged.

Marketing and ads have convinced many people to

invest in brand names and designers when even these companies are taking buyers for their money.

It’s no wonder many stray away from investing as they do not fully understand it and cannot find credible sources.

It’s hard to find companies that will educate you on how to invest in diamonds, what to invest in and

how to save your money.

The truth is finding a business that only deals with diamonds and gets them

from the source will lead you to the best investments for a healthy ROI.

If you choose a reputable diamond company and source, like Ajediam, your precious stones increase at a higher return than most investments on a consistent basis.

Diamond sellers who have been in business for decades also insure that your stones are certified by the safest and most controlled certifiers, mainly the Diamond High Council.

When you select the right products to invest in, you’ll experience a gain of at least 14% increase annually.

Indeed,

the past sixty years have shown that these rare stones increase by that rate year after year.

Diamonds are difficult to determine the value for.

Just one stone can receive many different opinions.

This is why valuing a diamond should be left to the true industry experts.

There are only a small handful of companies that can and will appraise, value and certify accurately.

They are so sure of their expertise that they are willing to sell your diamond on the 28 diamond bourses in the world and pay you the increased value.

Also, the bling’s value will be recognized and valued anywhere you go in the world.

When you choose to invest in sparkling jewels with the experts in the industry, you’ll hedge your savings and money from inflation, hyperinflation and economic crises.

You’ll also get educated on the corruption and excessive marketing which has led many to believe that companies such as DeBeers are the ones to buy from.

Yet the truth is many so-called diamond experts have only hoarded and controlled the mining industry and stockpiled poor quality diamonds.

They did not focus on mining for more top quality gems.

Learn all you can about investing in diamonds by contacting us here at Ajediam.

We offer free consultation and education so that you can make the best investments.

Like you, we’re concerned about the world’s economy and where it is heading.

Therefore, we even offer the world’s best Sell Back Program.

We are that confident of your increased gains when you invest in top quality diamonds with accurate, true and reliable certifications.