Diamond Prices

Read more

The Art Of Diamond Buying By Ajediam

Understanding pricing, knowing what to look out for, finding a serious diamond trader, comparing offers

Embarking on the journey to purchase a diamond can be as exciting as daunting. The glittering allure of these precious gems is undeniable, but so is the complexity that comes with valuing them accurately. At Ajediam, we believe that a well-informed buyer is a happy buyer. That’s why we’ve crafted this comprehensive guide to help you navigate the diamond buying process, ensuring you receive exceptional quality at a fair price.

This guide will arm you with the knowledge and tools to avoid overpaying. We’ll walk you through understanding diamond prices, recognizing the quality of diamonds, navigating the marketplace to prevent tricksters, and harnessing the power of comparison to find the best offer. By the end of this journey, you’ll not only be ready to make a smart diamond purchase but also confident in the value and beauty of your choice. Let’s dive into the glittering world of diamonds and discover how to buy these precious gems the smart way.

Understanding Diamond Prices: Your Key to Avoid Overpaying

When embarking on the journey to purchase a diamond, building an understanding of diamond prices is your first line of defense against overpaying. This awareness empowers you to make informed decisions, ensuring that you’re not just buying a diamond, but investing in a piece of lasting value.

Whenever you receive a quote for a diamond, it’s important to differentiate between the price of the diamond itself and the cost of the setting. While the cost of a setting can vary based on the brand, quality, and complexity of the design, the price of the diamond should be more consistent and predictable.

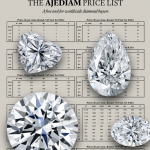

Diamond prices are guided by several key price lists, widely used by professionals in the industry. The most frequently referenced among these are the Rapaport and Idex price lists. These reputable sources provide a standard against which diamond prices can be compared, helping you ensure that you’re not paying more than you should.

However, for private buyers, these professional lists can sometimes be overwhelming. That’s why at Ajediam, we’ve created our own diamond price list, crafted with you in mind. Our list is free to access and designed to be easily understood by private buyers. We’ve taken care to make it user-friendly and comprehensive, integrating the current market discounts for each type of diamond category.

By equipping yourself with the right knowledge and resources, you can confidently navigate the world of diamond buying. Remember, the goal is not just to buy a diamond, but to purchase a piece of timeless beauty and value without overpaying. Trust reliable sources like Ajediam to guide you on this sparkling journey.

Recognizing Diamond Quality: The Cornerstone of Value

To start, only consider diamonds accompanied by reputable certification. At Ajediam, we strongly recommend diamonds with Gemological Institute of America (GIA) reports. The GIA is renowned for its rigorous and consistent grading standards, providing you with an accurate assessment of your diamond’s quality. An added assurance is the inscription of the certificate number on the diamond’s girdle – this not only validates the authenticity of the diamond but also links it directly to its grading report.

Next, develop an understanding of the factors that can devalue a diamond. For instance, fluorescence – the glow a diamond emits under ultraviolet light – is not always a defect, but it does lower a diamond’s price. The same is true for a diamond cut. A poorly cut diamond not only diminishes the stone’s brilliance and fire but also reduces its market value.

Particular attention should be given to avoiding diamonds characterized as BMGs – brown, milky, or green. These descriptors relate to undesirable color tones, cloudiness, or hue that can significantly devalue a diamond. As industry insiders, when purchasing a diamond remotely, we always ask, “No BMG?” to ensure we’re acquiring a fine jewelry quality stone.

By understanding the factors that define a diamond’s quality and how these are represented in a certificate, you can avoid overpaying and make a purchase that truly represents value for money.

Navigating the Market: Steer Clear of the Tricksters

As you delve deeper into the world of diamond buying, it’s paramount to stay vigilant and avoid falling prey to misleading practices. The diamond industry is generally a world where trust is the key. As with any sector, there are those who may attempt to trick unsuspecting buyers.

One common pitfall is the allure of dramatic sales offers. While a “50% off” or “70% off” sale might seem like a golden opportunity, such discounts are virtually non-existent in the diamond industry. The value of diamonds is tied closely to their quality and global market trends, not promotional sales. Be wary of such offers; they often mask inflated original prices or lower-quality diamonds.

Similarly, be cautious about grading reports that come from non-reputable sources, especially those produced in-house by diamond jewelry stores. Without the stringent standards and unbiased perspective of a reputable external grading lab, such reports can be misleading. We strongly advise that you only consider diamonds accompanied by grading reports from recognized authorities like the GIA.

When selecting where to buy your diamond, seek out reputable dealers with good standing in the industry. Look for those who are members of recognized diamond bourses, such as those in Antwerp, which adhere to strict ethical and professional standards.

By staying vigilant and following these guidelines, you can confidently navigate the diamond-buying process. Trustworthy dealers, backed by memberships in recognized bourses, provide reliable guides in your diamond purchasing journey, helping you steer clear of tricksters and avoid overpaying. Read more about what to look out for to avoid being misled.

Finding the Best Offer: The Power of Comparison

In your quest to find the perfect diamond without overpaying, the power of comparison cannot be underestimated. Just like any significant investment, it’s essential to gather several offers from different traders before making a decision. This approach gives you a broader view of the market, helps you understand the value of what you’re buying, and allows you to discern which trader is the most trustworthy and offers the best value.

Collecting multiple offers is more than just comparing prices; it’s about gaining a holistic understanding of what each trader brings to the table. Consider their reputation, the quality of their diamonds, the comprehensiveness of their grading reports, and their commitment to customer service. This will not only help you get the best price but also ensure you’re buying from a reliable source that stands behind its diamonds.

At Ajediam, we believe in transparency and value-based pricing. We encourage you to compare our offers with those of other traders. Not just because we’re confident in our competitive pricing and the quality of our diamonds, but because we believe that an informed buyer is a satisfied buyer.

By seeking out multiple offers and comparing them, you’re taking a proactive step to ensure you’re not overpaying. You’re also getting a better understanding of the diamond market, which will serve you well not only in this purchase but in any future diamond investments you may make.