Diamond Prices

Read moreInvestieren In Diamanten

Diamanten als Wertschutz, Investition und alternative Anlage...

Sie bekommen Sicherheit, Rendite, Flexibilität, Steuervorteil und Anonymität Schauen sie die historischen Diamantenpreise bis zu Heute am Tage. Der Wert des Diamanten ist jedes Jahr um mehr als 14.7 % erhöht = Jährliche 4.3%, steuerfreie Zinseszinsen seit 1960, dass heisst über 56 Jahre!

- – Jahressteuerfreie Erträge von 3% Cash jedes Jahr auf ihr Bankkonto während 8 Jahren

- – Ihre Anlage, Diamanten bleiben in Ihr Besitz – Keine wertlose Papiere!

- – Versicherung gegen Diebstahl und Verlust

- – Liquidität: Bargeld – Wieder-Verkauf wird von uns garantiert mit Vertrag auf die Verkauf – Rechnung

Diamonds, the ultimate plant ...

“I never regretted buying diamonds … they are a good investment” Warren Buffet

Is this the end of paper money?

Paper money is calculated at nothing.

It is a promise that you hold in the palm of your hand. Its value is not with a solid object, eg. Gold secured.

That’s why central banks are currently printing thousands of billions of dollars, pounds and euros, even though this huge sums of money are not backed up by anything tangible.

Whether this policy works or not, there is no doubt that it is a risky option that could turn the world back to the hyperinflation of the 1930s.

Western countries are struggling with a debt of enormous proportions for which they can not find an adequate solution. In the meantime, the debt continues to accumulate, which will lead to an implosion of paper money: the debt bubble will burst *.

Is there a better way than this kind of speculation …

There are. They are diamonds, the hardest currency in the world

Diamonds are the smallest, lightest and most concentrated form of wealth in the world.

You know what makes them special.

They are easy to wear discreetly – and their values continue to rise!

Invest in Excellence ...

On average, diamond prices have risen more than 14% per year for more than 50 years.

Nothing else can match this track record of stable and rising value …

plus astounding resilience in times of political volatility, social unrest and financial crises.

Diamonds have historically, year to year, a constant positive growth of capital, in contrast to the volatility of precious metals or stocks.

On average, diamond prices have increased by more than 14 % per annum for over 50 years.

Nothing else can match this track record of stable and increasing value …

plus amazing resilience during times of political volatility, social unrest and financial crises.

Diamonds historically have a steady positive capital growth unlike precious metals or shares with material volatility year to year…

Summarized advantages of investment diamonds:

- Remarkable ROI ROI

- You invest in diamonds. You get diamonds not papers nor promises

- Resilience against banking crises and currency reforms

- A reassuring investment in crises

- History shows amazing proof against inflation

- Capital gains on sale can be highly tax efficient

- Sales are not subject to statutory reporting requirements

- Anonymity – diamond sale is not subject to any reporting requirement

- Attractive way to enhance income after retirement

- Traded globally in US$, potential for currency gains

- No withholding nor property tax

- Always in demand, giving further price stability / increase

Does a diamond have a suitable value in terms of value?

Yes, it has and here is why:

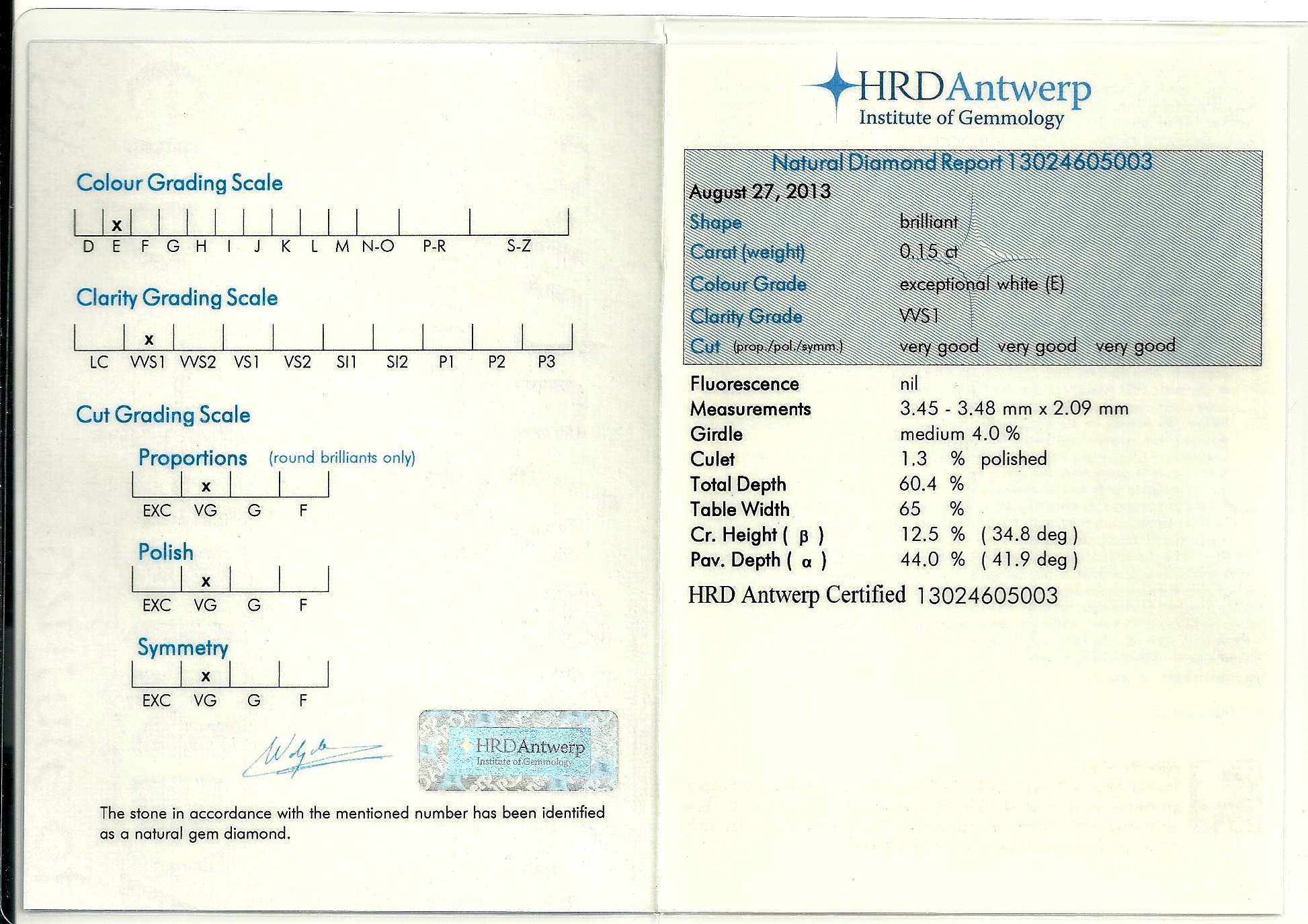

[vc_tta_accordion]1. The quality of a diamond has accurately been certified

by one of the three globally reputable Diamond labs, being

HRD – Diamond High Council – Hoge Raad voor Diamant,

GIA – Gemological Institute of America,

IGI – International Gemological Institute.

Diamonds from Ajediam are always polished to perfection by skilled Antwerp cutters.

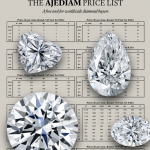

2. Sales to universal wholesale prices

Based on these quality descriptions, the value of a diamond can be

calculated by the internationally recognized Rapaport AVERAGE wholesale prices,

the industry standard for all professional diamond businesses.

3. And now the innovation, the missing piece in the puzzle is found:

the “Diamond valuation certificate” which determines the value based

on the quality criteria and the Rapaport prices with Resale Guarantee!

In fact, the “Diamond valuation certificate” is the perfect paper counterpart.

Total transparency with the Diamond valuation certificate

Total transparency:

1. quality certified diamonds

2. universal wholesale prices

3. Cash re-sale guaranteed with contract and terms on the sales invoice!

This way investing in diamonds is safe and secure.

You can be sure of a profitable return on investment on the medium and long term*.

(*medium term: 8 years – long term: 15 years)

Recommendation: Set the diamond in a jewel. Enjoy it every day. It retains its value!

Who created the “Diamond valuation certificate”? Ajediam*

How and where to buy and sell with resale guarantee:

At the issuing authority : Ajediam

and partners all over the world

Ask for Ajediam’s Diamond Investing Guide and the partner in your area Email

Ajediam is member of all the Diamond Bourses in the World.

There are 28 diamond bourses in the world. The three biggest ones are located in Antwerp.

Nowadays, practically all diamonds are traded electronically based on the international Rapaport wholesale prices on the 28 diamond bourses around the globe = resale guaranteed!

As members of the Diamond Exchange, Antwerpsche Diamantkring, and the World Federation of Diamond Bourses we operate in an arbitrated and safe environment. Reliability and responsibility is what makes Ajediam a successful business choice since more than 30 Years.

You can buy an investment diamond with a “Diamond valuation certificate” and with his unique sell back guarantee from US $ 5,000

Is this the end of the paper money? Will there be a hyper inflation? Nobody can really predict…

But what we can predict is that diversification through diamonds issued with a

“Diamond valuation certificate” is absolutely an outstanding investment.

Do it now!

Read more about “The end of Fiat money?” ask google

Diamonds as investment with the innovative Valuation Diamond Certificate Concept…

How it works:

- You determine the amount or budget to invest and we suggest you the diamonds + Yearly Tax Free Income of 3% during 8 years*, *contract on invoice,

- diamonds are in your possession!

*Past performance does not guarantee the performance of the future. - The diamonds for your investment will be minutiously selected by our grader, giving you the best guarantee of ROI

*Bernanke has since the outbreak of the credit crisis, created out of thin air $ 2,757,000,000,000 in new paper money.

Thus to its goal of achieving maximum employment.

After five years of massive money printing is the active part of the labor force reached a new low of 63.2%.

A downright lousy result. Source: Jack Highland # 652, Friday, September 20, 2013 – www.stocktradingnieuws.com

Diamonds, the ultimate plant … Part 1

Lack of resources, production in diamond mines in decline and the demand for honed stones continue to increase around the world … Part 2

The value of the diamond is determined solely by its rarity … Part 3

Historic prices Trend curve Statistics 1960 – 2015 … Part 4