Diamond Prices

Read moreInvesting Diamonds Investment Part 3

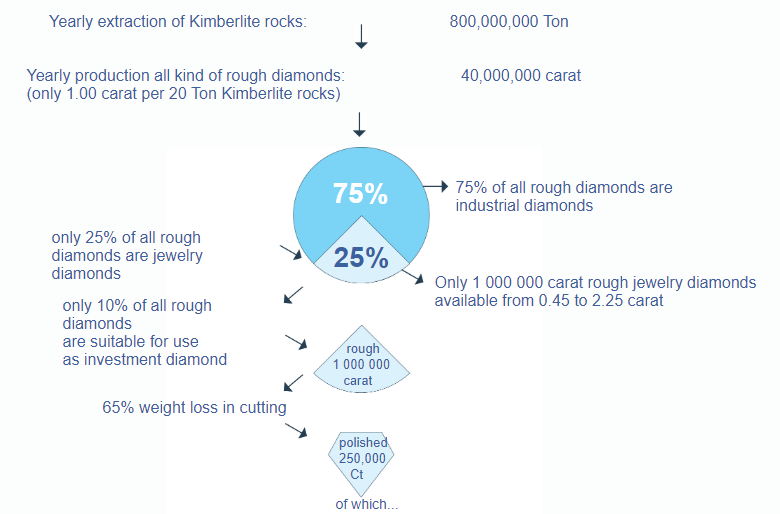

How much diamonds are in the world?

How rare are diamonds compared to other gems and synthetic diamonds?

The price of a natural, unearthed diamond is determined by its rarity…

Good to know… Only ONE percent of all polished diamonds, traded annually in the world, are bigger than 0.30 carat!

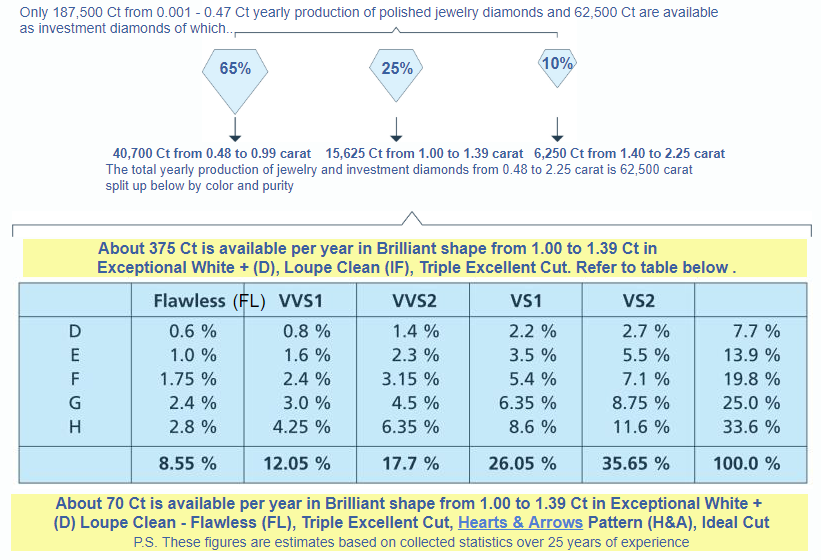

Only about 375 round brilliant diamonds from 1.00 to 1.39 Carat D IF in Ideal Cut, Triple Excellent – H&A, are available per year and only about 70 in Flawless (FL) quality are available per year in the world.

Gems, such as Ruby, Emerald and Sapphire of high quality, in bigger sizes can score high prices.

Tim Treadgold, Contributor at FORBES wrote

Diamonds Could Soon Be An Investor’s Best Friend As Diamond Demand Rises And Supply Falls

Source: Forbes, Tim Treadgold, Contributor, covering stories in the mining and oil industries.

Column Energy article 10/24/2013 @ 11:43AMger

Schematic diagram representing volume, from excavation to polished diamonds showing how much diamonds are in the world

Diamonds might be a girl’s best friend but from next year they could also be an investor ’s best friend thanks to a global decline in the production of quality gems from mines in Russia and Canada, and rising demand, particularly in China.

Declining Production

what analysts at Citigroup have detected is a change in the outlook for diamond demand, a significant decline in the rate at which kimberlites (the host rock for most diamonds) are being discovered, and the drying up of a diamond stockpile once kept by the industry leader, De Beers.

A changed marketing policy by De Beers has seen it behave more as a conventional business, but the sell-down of its stockpile has reduced the buffer-effect so that when the next shortfall in mined diamond supply occurs there could be significant upward price pressure.

In the mining world, despite a worldwide search, there has been a very low rate of kimberlite discovery

FAQ

Is this an investment for everyone because of the difficulty in valuing individual stones?

Yes, it is an investment for everyone…

Has a diamond a suitable equivalent in terms of value?

Yes It has and here’s why:

1. The quality of a diamond has accurately been certified

by one of the three globally reputable Diamond labs, being

HRD – Diamond High Council – Hoge Raad voor Diamant,

GIA – Gemological Institute of America,

IGI – International Gemological Institute.

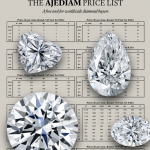

2. Sales to universal wholesale prices

Based on these quality descriptions, the value of a diamond can be

calculated by the internationally recognized Rapaport wholesale

prices, the industry standard for all diamond business.

3. Total transparency with the lifetime Resale Guarantee!

And now the innovation, the missing piece in the puzzle is found:

the “Diamond valuation certificate” which determines the value based

on the quality criteria and the Rapaport prices with Resale Guarantee!

In fact, the “Diamond valuation certificate” is the perfect paper counterpart.

One of the main lack is the sale back and terminal market*. Most commodities* have terminal markets, and some form of commodities exchange, clearing house, and central storage facilities. Until recently this did not exist for diamonds.

Now we do!

Commodities exchange for diamonds exist now:

How and where to buy and sell with resale guarantee:

At the issuing authority : Ajediam and partners all over the world

There are 28 diamond exchanges, bourses in the world. The three biggest ones are located in Antwerp

Ajediam is member of the Diamond Bourses in the World.

Nowadays, practically all diamonds are traded electronically based on the international Rapaport wholesale prices on the 28 diamond bourses around the globe = cash resale guaranteed!

*A terminal market is a central site, often in a metropolitan area, that serves as an assembly and trading place for commodities.

*The exact definition of the term commodity is specifically applied to goods . It is used to describe a class of goods for which there is demand, but which

is supplied without qualitative differentiation across a market.

You can win unexploded capital gain out of diamonds investment under today’s spiral and depressed economy.

The investment parameter of diamonds is their high value per unit weight, which makes them easy to store and transport. A high quality diamond weighing as little as 2 or 3 grams could be worth as much as 100 kilos of gold. This extremely condensed value and portability does bestow diamonds as a form of emergency funding.

People and populations displaced by war or extreme upheaval have utilised this portable asset successfully.