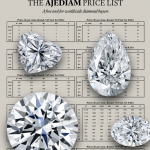

Diamond Prices

Read moreInvesting Diamonds Investment Part 2

Expectations of price evolution of diamonds... Lack of resources, production in diamond mines in decline.

Several diamond mining companies report big loss and the demand for cut stones continues to increase around the world…

This will end in sharply rising diamond prices.

Read about trend signals: Letšeng Mine reports… rough prices +50%

Rapaport news.. Stornoway Diamond Corporation reported a loss of $11.5 million.

Mine Production in Angola fell 2 percent year on year. Reported y Deena Taylor. RAPAPORT…

Rio Tinto’s diamond production fell 15 percent year on year.

Worldwide demand for polished goods continues to rise

The world production of premium cut diamonds in D Color: Exceptional White + (D) Clarity: Loupe Clean (IF)

Weight: from 1 Carat to 1.39 Carat is less than 900 Carats per year.

That means that, all together, there are only 375 stones between 1.00 Carat to 1.39 Carat D Loupe Clean available per year for the whole world-production!

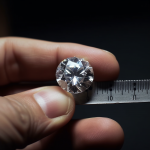

To produce these 375 diamonds, the mining companies have to dig more than 800,000,000 Tons of Kimberlite.

(Kimberlite is the rock in which rough diamonds are found)

Gareth Penny of De Beers states in November 2008 that, if we continue diamond mine at this rate we are within 20 years without!

Alrosa, BHP Billiton, De Beers and Rio Tinto are the top players in the diamond mining industry.

BHP Billiton and Rio Tinto are trying to sell their diamond mines due to lack of profit, accounting for less than 1% of the miners profit.

Alrosa starts to sell their diamond mine shares to cover their huge loss.

De Beers has already sold some of its diamond mines, changing his policy from diamond miners into wholesalers.

It is clear that this lack of efficiency due to the exhaustion of the mines will result in greatly increased prices for natural diamonds.

BHP Billiton exited the diamond industry and Rio Tinto failed to find a buyer for its diamond unit. Even a possible IPO by Rio Tinto looks out of the question at this point, as Argyle, which turned into a $2 billion money pit.

Picture of underground mining at the Finsch mine in South Africa. Search for your diamond in this mass of rocks! (Source: Petra Diamonds).

Be in advance to the Diamond Decade!

The diamonds market outlook is very positive, with demand growing strongly and lack of new discoveries limiting supply!

The world economy will experience massive growth over the next decade.

More people will accumulate more wealth than ever in the history of mankind.

Millions of new middle and high class consumers will create unprecedented demand for diamonds and diamond jewelry.

But the quantity of natural diamonds is limited and natural quality diamonds are very rare.

Prices will rise to unexpected height.

The Long-Term Future is Bright

Example: The number of middle-class households in India and China is forecast to leap from an estimated 216 million this year to 469 million about US $160 billion is estimated to be spent on fine jewelry in 2014

The asset allocation is largely determined by the return on investment

Rough diamond prices continued to rise and so the polished diamonds too.

Christie’s NY jewelry news

Christie’s NY jewelry sells for $52.5m (90% by lot), Bulgari ring with 10.95 ct, fancy vivid blue, VS2 and a 9.87 ct, G, VS1 triangular diamonds sells for $15.8m ($1.4m/ct).

Comparison ….

Diamond is better than any investment in shares, securities, life insurance plans, options, derivatives, interest on savings accounts, stocks, bonds, gold, silver, platinum, mining, commodities or real estate.

Diamonds are a thousand times rarer than gold. Gold is hard to handle. It is also used as a speculative asset, so its value is volatile. Diamonds are stable.

The diamond market is more tightly regulated.

You can only trade diamonds that you own.

This cuts speculation out of the market – bar the natural growth in value that follows the imbalance between supply and demand.

The high degree of rarity of a diamond makes up its value.

In addition diamond has a high value for its very low weight, it is easy to transport.

Now the European Central Bank has turned the printing presses to bail out banks, there is a ‘game changer’ that Europe brings in a similar position as the United States and Britain: a monetization of the debt crisis.

Be in advance to any situation

Wear diamonds in diamond jewelry, easy to trade in case one needs cash.

Wear your diamonds in jewelry, totally legal, to any destination.

Easy to deal with over all the world, if you need cash.

We are always ready to serve you in any situation and in any country.